HELP

HELP

-

OUTAGES

-

Call888.313.4747

-

(Available 24 hours a day/7 days a week)

-

CONTACT US

-

General Inquiries/Service Requests:

-

Call888.313.6862

-

E-mailcontactcenter@oncor.com

-

(Monday-Friday, 8 a.m.-6 p.m. Central Time)

- New Construction Assistance

-

OUTAGES

-

Call888.313.4747

-

(Available 24 hours a day/7 days a week)

-

CONTACT US

-

General Inquiries/Service Requests:

-

Call888.313.6862

-

E-mailcontactcenter@oncor.com

-

(Monday-Friday, 8 a.m.-6 p.m. Central Time)

- New Construction Assistance

-

- FOR HOME

- SERVICE ASSISTANCE

- Electric Service Changes

- Start New Electric Service

Visit powertochoose.org - New Construction: Submit A Request

- Existing Project Status: Get An Update

- METERS

- Check My Meter Usage

Visit smartmetertexaas.com - Disconnect or Reconnect a Meter Temporarily

- What is My ESI ID?

- Check My Meter Usage

- ENERGY

SAVINGS

- SAFETY

- FAQs

- SERVICE ASSISTANCE

- FOR BUSINESS

- SERVICE ASSISTANCE

- METERS

- Check My Meter Usage

Visit smartmetertexas.com - Disconnect or Reconnect a Meter Temporarily

- What is My ESI ID?

- Check My Meter Usage

- PORTALS

- SERVICE ASSISTANCE

- CONSTRUCTION & DEVELOPMENT

- PARTNERS

- SMART ENERGY

- INVESTOR RELATIONS

- ABOUT US

- FOR HOME

Residential Customers

Manage your electric bill, get help with your energy service, and access information about our education and safety programs.

- FOR BUSINESS

- Construction

& Development

Construction & Development

Learn how Oncor helps the builders and developers who play a vital role in our state’s economy.

- PARTNERS

Partners

Learn how Oncor partners with a variety of trusted retail electric providers, suppliers, energy-efficiency contractors, tree-pruning contractors, and more to ensure our customers receive exceptional service.

Retail Electric Providers (REP)Register or Login Competitive Retailer Information Portal (CRIP) Portal

Register or Login to Aggregators, Brokers, Consultants (ABC) Portal

- SMART ENERGY

Smart Energy

Every day, we’re on a path to progress—using the latest tools and methodologies to better serve the people of Texas.

Electric VehiclesLearn about our ongoing commitment to innovative solutions and services that benefit millions of Texans.

Renewables, Solar & MoreOncor works cooperatively with customers to ensure a safe and reliable interconnection of renewable energy sources to our system.

Energy EfficiencyFind information on a variety of energy efficiency and renewable energy incentive programs offered by Oncor.

- INVESTOR RELATIONS

Investor Information

Filings, financial news, and information relating to corporate governance and sustainability.

- ABOUT US

ABOUT US

From our founding in 1912 to our role as a 21st century energy innovator, the people who make up Oncor are advocates for reliable energy and great service.

TAX INFORMATION

COMPLETED FORMS 8937

Form 8937 2020 Debt Exchange

- Filename

- Form 8937 (2020 Debt Exchange).pdf

- Size

- 3 MB

- Format

- application/pdf

PRIOR INFRAREIT STOCKHOLDER INFORMATION

NEWS RELEASE: Oncor Completes InfraREIT Acquisition

INFRAREIT / ONCOR MERGER CONSIDERATION INFORMATION

Former InfraREIT common stockholders may contact the Shareowner Relations Department of Equiniti, the paying agent, with any questions about the exchange of their shares of InfraREIT for the cash merger consideration at 1.800.468.9716.

TAX INFORMATION

ANNUAL 1099-DIV

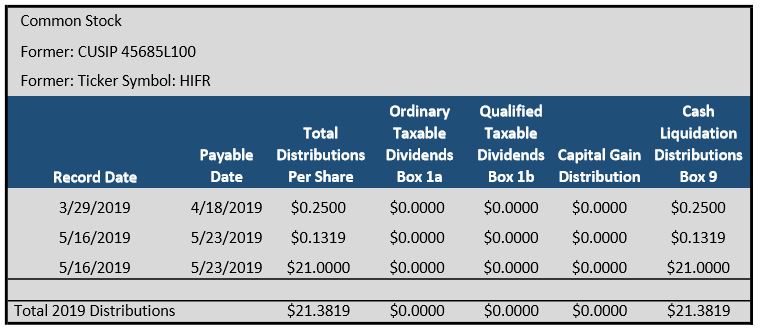

2019 COMMON STOCK TAX INFORMATION

On behalf of former InfraREIT, Oncor provides the following tax information to former InfraREIT common stockholders pertaining to the character of distributions paid during 2019, including how the allocations will appear on Federal Form 1099-DIV:

This was a final distribution due to the Company’s merger on May 16, 2019.

This information represents final income allocations.

Nothing contained herein should be construed as tax advice. Former InfraREIT stockholders are urged to consult with their personal tax advisors as to their specific tax treatment of InfraREIT’s distributions. Furthermore, you may not rely upon any information herein for the purpose of avoiding any penalties that may be imposed under the Internal Revenue Code.

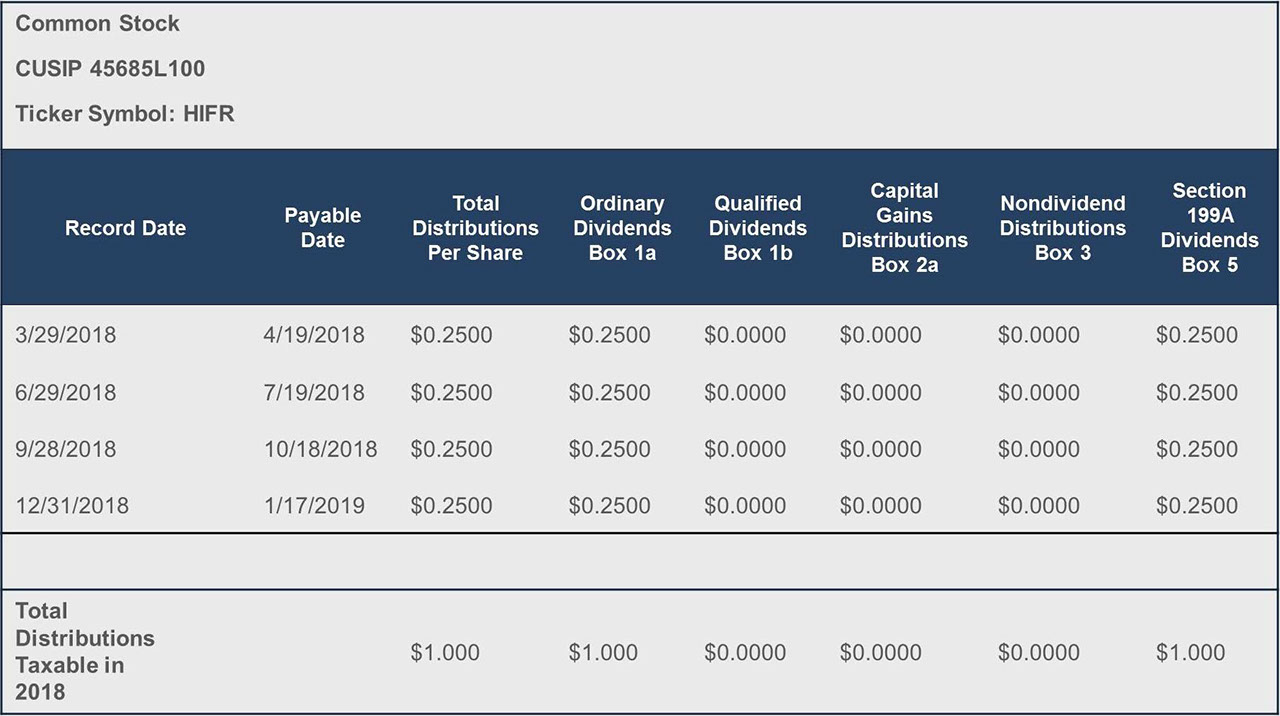

2018 COMMON STOCK TAX INFORMATION

On behalf of former InfraREIT, Oncor provides the following tax information to former InfraREIT common stockholders pertaining to the character of distributions paid during 2018, including how the allocations will appear on Federal Form 1099-DIV:

Box 5: Dividends in Box 1a are eligible for the 20 percent qualified business income deduction under section 199A.

Nothing contained herein or therein should be construed as tax advice. Former InfraREIT stockholders are urged to consult with their personal tax advisors as to their specific tax treatment of InfraREIT's distributions. Furthermore, you may not rely upon any information herein for the purpose of avoiding any penalties that may be imposed under the Internal Revenue Code.

Report of Organizational Actions Affecting Basis of Securities

Issuers of corporate securities must complete Federal Form 8937 to report organizational actions, including nontaxable distributions that affect the basis of the securities involved in the organizational action. The information contained herein does not constitute tax advice and does not purport to be complete or describe the consequences that may apply to particular categories of shareholders. The information contained in Federal Form 8937 is intended to satisfy the requirements of public reporting under sections 1.6045B-1(a)(3) and (b)(4) of the Treasury Regulations and as a convenience to shareholders and their tax advisors when establishing their specific tax positions.

Completed Forms 8937

2019 Form 8937 Final May 16

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2019 Form 8937 May 9

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2019 Form 8937 April 2019

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2019 Form 8937 March 2019

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2018 Form 8937

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2017 Form 8937

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2016 Form 8937

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2015 Post-IPO Form 8937

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf

2015 IPO Form 8937

- Filename

- 2019_Form_8937_Final_May_16.pdf

- Size

- 343 KB

- Format

- application/pdf